Source: Alizila

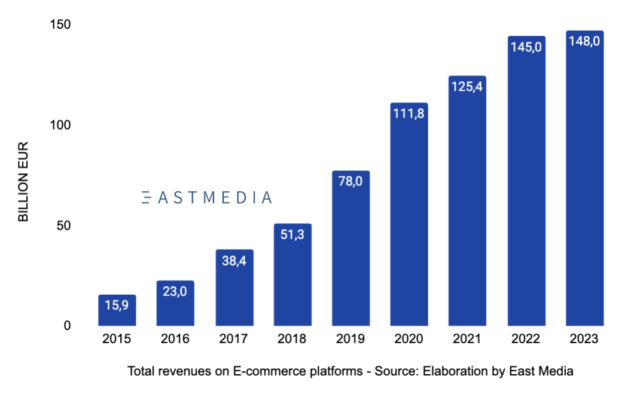

Double Eleven, also known as 11.11, stands as the most important event in the landscape of shopping festivals in China and beyond. In 2023, total sales across major online platforms reached 1.139 trillion yuan (about 148 billion euros), marking an increase of 2.1% from the previous year. Notably, brands on Tmall and Taobao recorded a significant increase in their revenues.

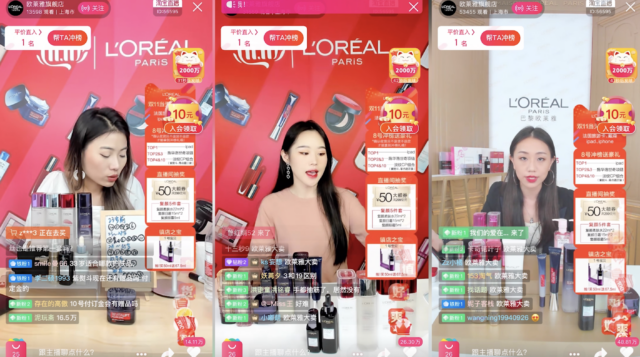

Online sales through live streaming, on platforms like Douyin, KuaiShou, and DianTao, reached 215 billion yuan (28 billion euros) and showed a substantial and outstanding growth of 18.5%. Traditional e-commerce purchases made on the three e-commerce giants, Tmall, JD, and Pinduoduo, accounted for a GMV of 923.5 billion yuan (119 billion euros), representing 81.1% of the total online sales for 2023.

Given the steady increase in purchases during live streaming, the role of KOLs, or Key Opinion Leaders, collaborating with brands as brand ambassadors to promote products in live streams and on social media, has become crucial to drive the consumers.

Source: Alizila

Major platforms have adopted various strategies to increase their sales volume and enhance competitiveness. JD, aiming to attract consumers, introduced a pre-sale period, allowing brands to sell their products at discounted prices before the festival starts. Tmall, in a similar period as JD, sold items by offering lower prices than its competitors. Beyond discounts, Tmall also leveraged AI technology, enabling brands to create a more immersive experience for the customer. Pinduoduo, on the other hand, allowed its customers an entire month of discounted shopping on the platform, by keeping the prices stable over a long period.

Regarded as the most significant event for boosting sales, major brands have leveraged the Double Eleven to implement a series of strategies to connect with Chinese consumers.

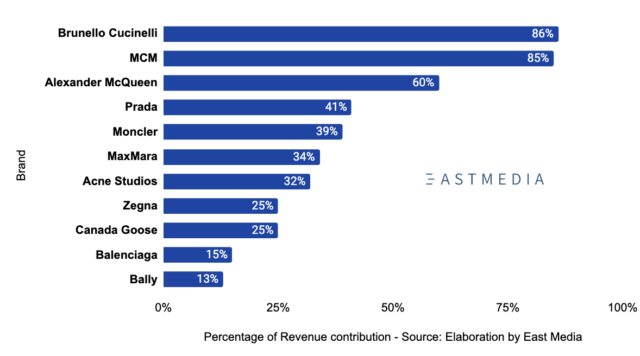

Performance of Major Brands

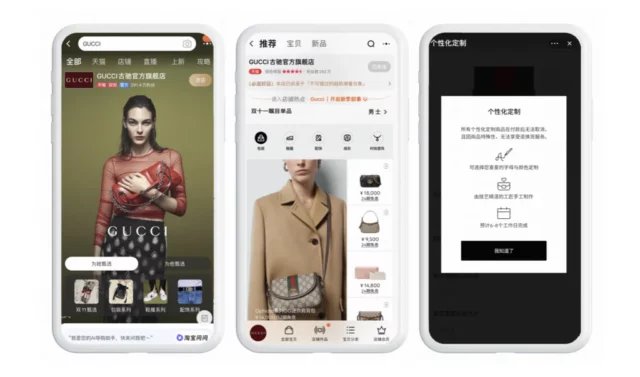

The behavior of Chinese consumers has shifted considerably, becoming more sophisticated and demanding. Today’s consumers primarily focus on value, quality, and the experience tied to the entire product purchasing journey. Therefore, holidays of the Chinese calendar have become the perfect events to create the best “digital showcases” to attract Chinese consumers.

During Double Eleven, brands like Canada Goose, Gucci, and MCM distinguished themselves with a more aggressive commercial strategy than in the past, further stimulating sales and attracting consumers to their online stores. MCM, for example, focused on some “hero products” that generated over 50% of total revenue during the festival. In contrast, other brands focused on the percentage of discounts applied to their products: as an example, Michael Kors offered discounts of up to 52%, while Balenciaga offered 37% off (a 14% increase from the previous year).

Source: Tmall Luxury

Launch of New Products and Pricing Strategies

Double Eleven is a significant showcase for international brands, comparable to Black Friday. Today, brands from all sectors take part in the event not just for selling at discounted prices but also as an occasion for launching new products.

The brand Miu Miu introduced 190 new full-priced products aiming for premiumization, similar to Brunello Cucinelli, which launched new products to capitalize on the significant number of consumers during Double Eleven, due to its popularity in China. Indeed, 84% of the turnover did not come from the sale of promotional products.

In addition to introducing new products, Chloé leveraged the pre-sale period to implement its strategy, selling overall about 90% of the promotional stock.

In a festival where discounts are a significant factor for increasing sales, some brands also pursued a strategy contrary to their competitors. The jewelry brand Cartier, for instance, changed its strategy during Double Eleven by eliminating zero-interest payment offers, leading to a 65% reduction in revenue compared to the previous year. This factor significantly impacted the brand’s performance during Double Eleven.

These are just some of the strategies that international brands have adopted to attract an ever-growing number of consumers, who significantly increase their purchases during this event.

Conclusion

During Double Eleven 2023, the increase in total sales, exceeding 148 billion euros, demonstrated the festival’s potential not only to influence sales volumes but also to shape consumer perceptions. The different strategies employed by many brands highlighted the importance of a deep understanding of today’s dynamic market and the growing significance of Double Eleven as a key moment not only for sales but also for the strategic positioning and branding in the luxury sector.